Overview

Worry free income validation

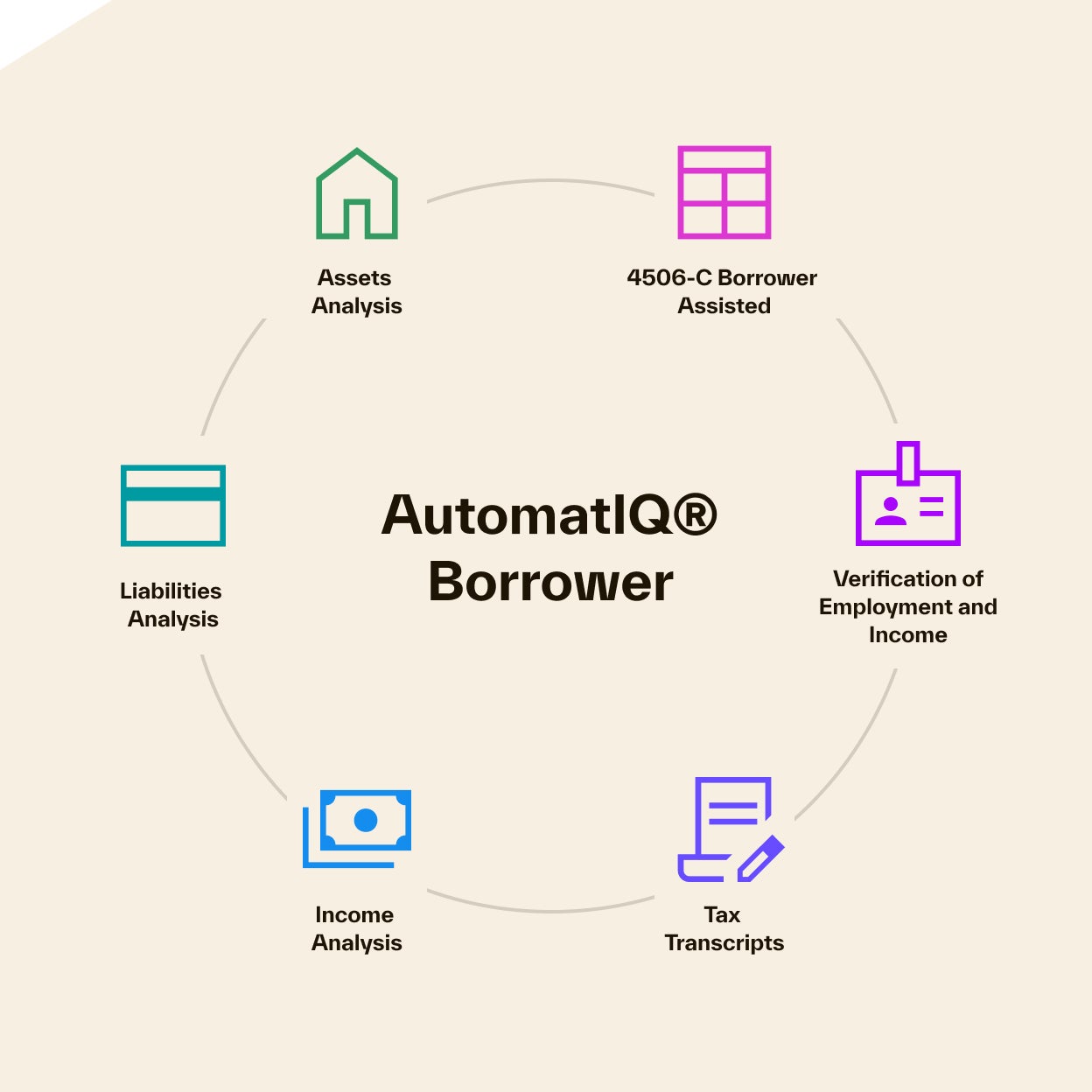

Physical piles of income verification forms and questions about self-employment income calculations are a thing of the past. With AutomatIQ Borrower Income Analysis, mortgage loan officers and underwriters can automate income validation within a single workflow for an accelerated loan qualification process.

In fact, results are so fast and so accurate that lenders can now focus their time on expeditiously qualifying more borrowers and fielding exceptional applications.

Consistent, accurate results every time

Focus on analyzing applications instead of tallying up income sources. Our solution keeps up-to-date records of income documents and delivers consistent results regardless of who generates the report.

Minimize repurchase risk, maximize RoI

Avoid loan repurchases and increase the number of borrowers you can qualify, even self-employed. Our solution delivers instant insight into income add-back opportunities to unlock better pricing and reduce debt-to-income ratios.

Instant GSE Rep and Warrant response

Upfront GSE Rep and Warrant decisions allow underwriters, processors and loan officers to compare income data, meet investor needs and generate reports with verified income sources and custom calculations. Records are securely stored in cloud-based LOS files.

Consistent, accurate results every time

Focus on analyzing applications instead of tallying up income sources. Our solution keeps up-to-date records of income documents and delivers consistent results regardless of who generates the report.

Minimize repurchase risk, maximize RoI

Avoid loan repurchases and increase the number of borrowers you can qualify, even self-employed. Our solution delivers instant insight into income add-back opportunities to unlock better pricing and reduce debt-to-income ratios.

Instant GSE Rep and Warrant response

Upfront GSE Rep and Warrant decisions allow underwriters, processors and loan officers to compare income data, meet investor needs and generate reports with verified income sources and custom calculations. Records are securely stored in cloud-based LOS files.

Report customization and collaboration

Choose report fields and order them however you need. Multiple users can work simultaneously on the same file, so teams can collaborate in real-time. Our income data continuously updates to deliver accurate data, every time.

Features

Automate income analysis. Simplify the complex mortgage workflow.

Multiple income sources? Calculate self-employed income? That’s easy. With a streamlined interface and productivity gains of up to 100%, our all-in-one solution helps quickly qualify borrowers and reduces the risk of loan repurchases.

.svg)

Get instant access to up-to-date data

Access Income Analysis instantly via ICE Encompass, the AutomatIQ Borrower Portal (Web UI) or directly integrated into any proprietary LOS or software workflow using the solution API for current data anytime of the day or night.

Secure records for a smooth workflow

Our easy-access, secure interface (SSO enabled) to store borrower income calculations, mortgage applications and qualification files in one, searchable location with. An audit trail is maintained for compliance with GSE, FHA, and ATR rules.

Leverage a GSE-approved solution

Mortgage loan origination is a lengthy process, don’t wait to know if a loan application meets GSE standards. With Income Analysis, the legwork is already done.It's pre-certified for Fannie Mae and Freddie Mac Rep and Warrant programs from day 1.

Step-by-step instruction to reduce human error

Although many individuals need to review an income calculation report, not everyone needs to see the same thing. Our solution makes workflow adjustments to provide loan officers and underwrites with a guided experience that simplifies the complex income verification step of the mortgage workflow.

FAQ

How does Income Analysis help in risk mitigation?

Income Analysis helps mitigate risk by leveraging its rigorous and consistent rule engine, allowing lenders to protect themselves and their investors from unwanted financial compliance and regulatory risks. All calculations are transparently displayed with a complete user change history available.

Is AutomatIQ Borrower Income Analysis integrated with Freddie Mac® and Fannie Mae® Rep and Warrant programs?

Yes, AutomatIQ Borrower Income Analysis is integrated with both Freddie Mac and Fannie Mae, ensuring a seamless transfer of data and compliance with regulations for Rep and Warrant relief for certain transaction income calculation types. Additionally, AutomatIQ Borrower Income Analysis provides all the required raw income data in an accessible format, enabling the GSEs to perform their computations and efficiently ensure Rep and Warrant relief.

What makes Income Analysis different from other solutions that calculate income for mortgages?

Income Analysis is a single underwriting solution for all income types — including self-employed income calculations. Reports do not need to be keyed into another spreadsheet or calculator. Wages, Commission, Bonus, Rental, Retirement, Investment, Asset, and Self Employment can all be underwritten in one tool that generates a singular, compliant PDF report with all qualifying calculations.

Is Income Analysis a static report or an intelligent solution?

Income Analysis is an intelligent solution using advanced algorithms to analyze income data and provide accurate results that drive lender workflows and efficiencies. This technology adapts to different income scenarios across all income types.

Can Income Analysis be used for both simple and complex loan profiles?

Yes, Income Analysis can be used for both simple and complex loan profiles. The solution can handle complex income scenarios and provide detailed analysis for various income types. It is designed to simplify the complex income calculation process and provide accurate results for all loan profiles.