Overview

A streamlined approach to asset analysis

Navigating the multifaceted aspects of asset analysis can be daunting. Not anymore.

Get a comprehensive solution tailored to the mortgage market’s specific needs that simplifies asset verification and analysis, ensuring unmatched precision and speed.

With a customizable platform, you have seamless integrations to fine-tune procedures and set a new standard in asset analysis.

Represent assets accurately, quickly

Say hello to a better way to make loan approval decisions. Our Verification of Assets solution integrates with AutomatIQ Borrower Assets Analysis for a faster, more accurate representation of available funds. Categorize by type, review with visualizations, and quickly highlight potential fund shortages.

Visualize data interactively

Asset verification and analysis has never been easier. Our interactive interface and available funds visualization tool make asset analysis a breeze. The visual breakdown of funds and quick access to account overviews simplify the asset verification process, improving the overall user interaction with the platform.

Minimize underwriting cycles

The Assets Analysis tool alerts loan officers about the need for documentation on terms of withdrawal or liquidation requirements. By proactively collecting documents, you can minimize underwriting cycles and provide a smooth progression through the loan origination process.

Represent assets accurately, quickly

Say hello to a better way to make loan approval decisions. Our Verification of Assets solution integrates with AutomatIQ Borrower Assets Analysis for a faster, more accurate representation of available funds. Categorize by type, review with visualizations, and quickly highlight potential fund shortages.

Visualize data interactively

Asset verification and analysis has never been easier. Our interactive interface and available funds visualization tool make asset analysis a breeze. The visual breakdown of funds and quick access to account overviews simplify the asset verification process, improving the overall user interaction with the platform.

Minimize underwriting cycles

The Assets Analysis tool alerts loan officers about the need for documentation on terms of withdrawal or liquidation requirements. By proactively collecting documents, you can minimize underwriting cycles and provide a smooth progression through the loan origination process.

Features

Determine your borrower's assets with accuracy and ease

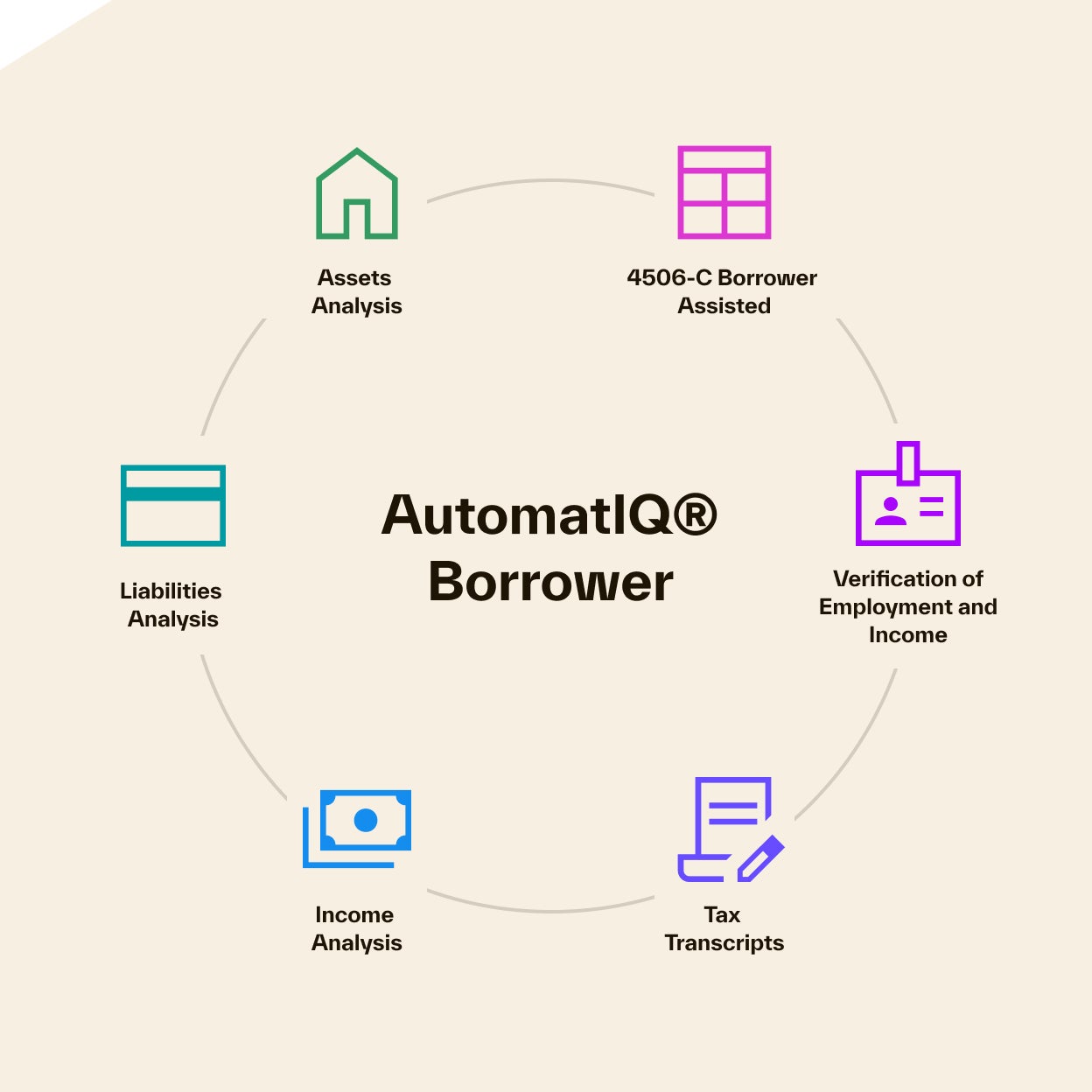

Cotality’s AutomatIQ Borrower Assets Analysis empowers clients to tailor their verification strategy while optimizing for cost-efficiency, speed, and depth of coverage that align with their business objectives.

.svg)

Direct linking of borrower accounts

Our Assets Analysis solution ensures accurate results by allowing the option to directly link a borrower’s accounts. Using Cotality’s Verification of Assets (VOA), Assets Analysis offers borrowers a seamless, digital platform to connect their financial accounts and ensure accurate, up-to-date verification of available assets.

Evaluation of physical bank statements

Some borrowers may not wish to link their accounts. Our solution provides the option to upload physical bank statements. Then, our tool digitally extracts the financial data from the statements and helps the lender complete a full analysis of accounts by checking for data completeness, accurate period coverage, and proper account ownership.

Interactive fund visualizations

Identifying the missing link in loan funding is a game changer. Assets Analysis visualizes a borrower’s assets, categorizes them, and compares them to the funds required to fulfill a transaction. Lenders can quickly assess any shortfalls for a clear and immediate understanding of a borrower’s financial readiness.

Consolidated data analysis interface

With the Assets Analysis tool, you can consolidate financial data in one place, even when digital linking does not procure all the required information, and a borrower provides physical statements. This tool ensures thorough checks across all transactions and account types and also provides an efficient method for integrated analysis when digital data is insufficient.

FAQ

Can Assets Analysis be used with any financial institution's data?

Yes, Assets Analysis can work with data from any financial institution if the borrower successfully links their accounts through the Cotality Verification of Assets service or uploads their bank statements. This versatility enables comprehensive asset analysis across a wide range of financial institutions.

Is there a limit to the number of documents Assets Analysis can process?

No, there’s no document cap for the Bank Statement Data Extraction feature used within Assets Analysis.

Is there a limit on the number of accounts or transactions Assets Analysis can handle?

No, there is no cap on the number of accounts or transactions that Assets Analysis can process. Whether you’re analyzing data from a single small bank account or you’re collating multiple accounts across various institutions with extensive transaction histories, Assets Analysis can accommodate your needs.

How quickly can lenders expect to receive results from Assets Analysis?

Assets Analysis is designed to deliver rapid results, allowing lenders to access data shortly after a borrower has completed their upload or connected a digital link to their financial institution(s). This swift turnaround is critical for maintaining efficiency in the loan origination process.

Can Assets Analysis be customized to meet specific lender requirements?

While Assets Analysis comes with a core set of features and capabilities, it can be modified to meet particular lender requirements, including tailoring the application of proprietary or specific program guidelines during the asset review process.