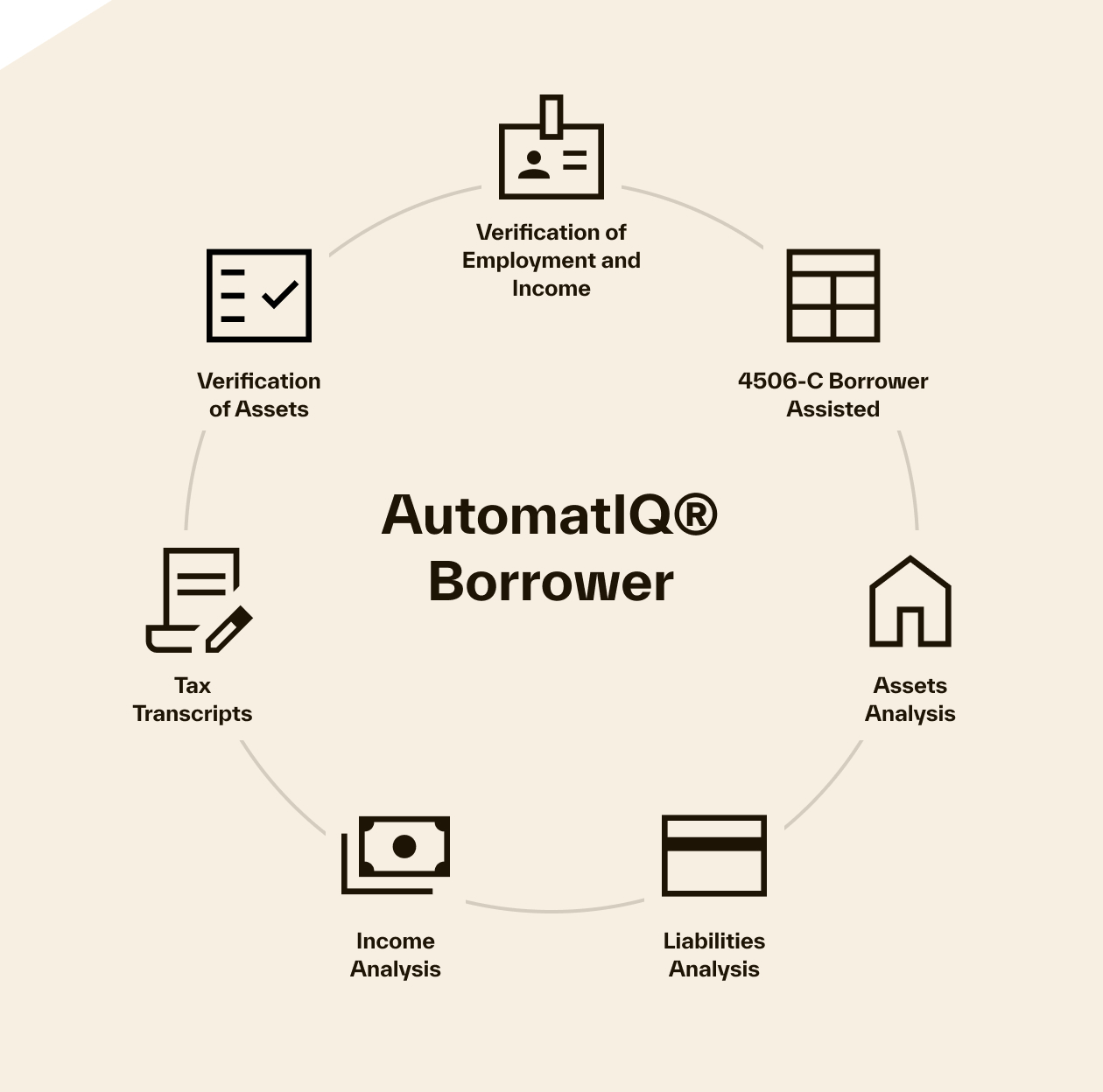

AutomatIQ® Borrower

One seamless mortgage lending workflow

Overview

Seamless, automated borrower verification

AutomatIQ Borrower transforms the manual operations of borrower verification and qualification into ONE seamless, automated workflow. Starting with our verifications solutions, you'll experience unmatched accuracy in handling digital or physical documents for simple or complex borrower profiles. Next, seamlessly move to our qualification solutions for deep, actionable insights into the borrower’s financial health.

.svg)