Overview

Heavy thunderstorms during the weekend of July 4 dropped more than 10 inches of rain across several Central Texas river basins, sending walls of water downstream and triggering widespread flash flooding across the region. Tragically, the disaster took more than 120 lives with at least 170 still missing, shaking Texas Hill Country communities. It is the deadliest flash flood event in U.S. history since the 1976 Big Thompson Canyon Flood in Colorado.

Our thoughts go out to those affected, many of whom face months of recovery ahead of them.

Update: July 21, 2025

Cotality estimates that the recent Central Texas flash floods caused $1.1 billion in damage to residential buildings and that the National Flood Insurance Program (NFIP) may provide as much as $135 million in insurance recoveries to home and business owners across the impacted counties.

The modeled damage to buildings only includes residential properties and excludes any damage to contents and additional living expenses (ALE). Using precipitation and stream-gauge data, Cotality recreated the flood footprint, but uncertainty persists about flood depth and extent, the share of properties with insurance, and the size of their deductibles and limits.

The Central Texas flash floods over the July 4 weekend caused about $1.1 billion in damage to residential buildings, yet they will likely have only a limited effect on primary insurers and reinsurers. Since flood insurance penetration in the region is sparse, most losses will fall on homeowners rather than insurers, which will leave households to shoulder nearly all reconstruction costs and expose a significant insurance gap.

More than the 100- or 500-year flood

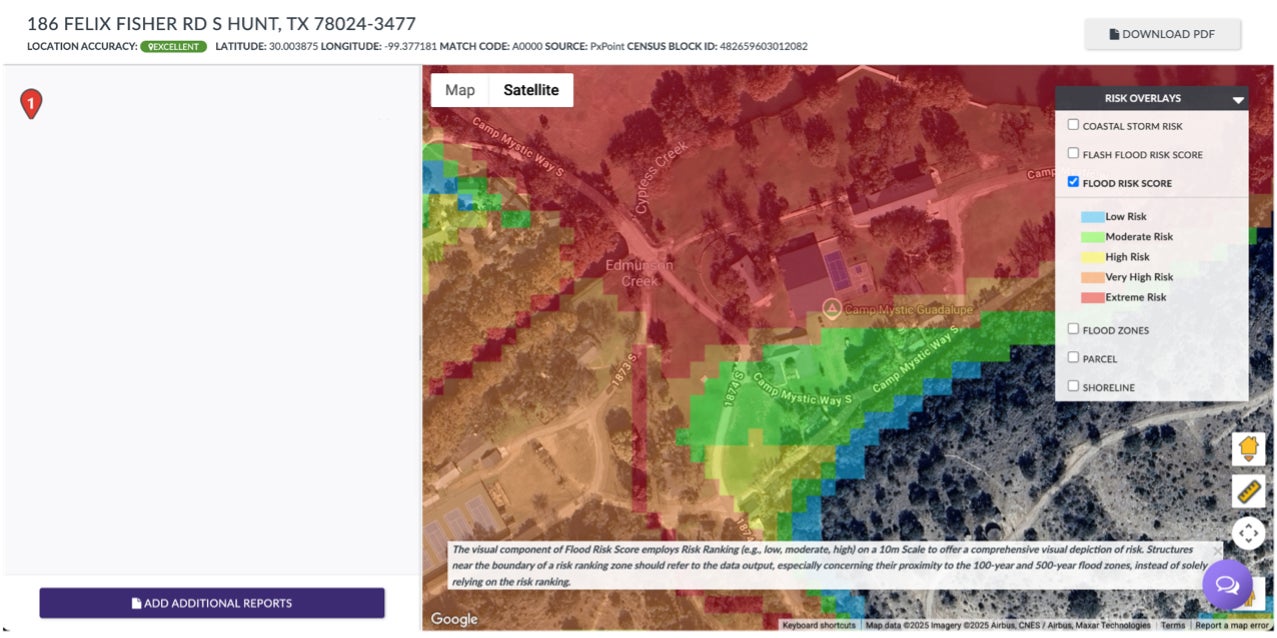

Cotality classified the July 4 Central Texas floods as a 1,000-year rainfall event based on local totals. This far exceeds the 100- and 500-year benchmarks in some areas. The disaster devastated local communities and showed that “low risk” zones do not mean zero risk. Figure 1, a Cotality Flood Risk Score map of Camp Mystic, reveals that every property carried at least some degree of flood risk.

Cotality Flood Risk Score map at Camp Mystic

Data source: Cotality, 2025

Even if a property sits beyond the 500-year flood zone line, it still faces risk. The areas just beyond the flood zone represent the highest amount of flood risk but stop after the boundary due to the amount of time and resources required to generate a flood map with a high degree of accuracy and precision. In other words, the 500-year flood-zone line marks the limit of data and budget, not a barrier that stops water.

Accurate flood zone mapping starts when survey crews record channel shapes, bridge profiles, and levees. Engineers convert those measurements into hydraulic models that track how water moves through dams, floodways, and culverts. This work is precise but time intensive. If a model relies only on two-dimensional flow equations and 30-meter elevation grids, it smooths sharp bends and storage pockets, widens flood outlines, and lowers reliability.

The storm’s scale underscores the value of merging detailed surveys, engineering plans, and site-specific hydraulics so flood models trace real flow paths and give planners more actionable guidance for mitigation.

Closing the Gap

The July 4 flash floods proved that extreme storms can push water far beyond mapped zones and damage homes people previously considered safe. Many Central Texas properties outside the 500-year floodplain still suffered heavy losses while limited insurance penetration left owners to shoulder most repair costs. To close this gap, the region needs clearer communication of residual hazard, stronger community mitigation, and wider uptake of flood coverage that turns a disaster into a more manageable setback.

Update: July 11, 2025

Preliminary property impact analysis

Cotality’s Hazard HQ Command Central™ analyzed the wide swath of impacted area across Central Texas. This initial analysis determined that:

- An estimated over 38,600 residential structures were within the flood footprint of counties that were deemed eligible for individual and public assistance by the Federal Emergency Management Agency (FEMA) and may have experienced flood damage

- Of these counties, Tom Green, Travis, Kerr, Williamson, and Burnet are home to the greatest number of residential properties potentially impacted by flooding.

Number of residential properties by county within modeled flood footprint in counties determined to be eligible for individual and public assistance by FEMA

Data source: Cotality, 2025

Not all properties within the flood footprint were damaged. While the analysis did consider the First Floor Height (FFH) elevation, any residential property with as little as 1 inch of water was considered impacted. The total number of damaged properties will likely be a subset of the 38,600 identified in Cotality’s initial analysis.

About the Central Texas storm

The Hill Country of Central Texas lies in what is known as “Flash Flood Alley,” a corridor along the Balcones Escarpment. It is an area of steep, limestone hills with thin soils and urbanized corridors that quickly move rainwater into rivers. The alley stretches from San Antonio through Austin to Dallas. Flash floods are common in this area because of the combination of unique terrain and Gulf-fed storms with heavy and prolonged rainfall.

The rainfall event that caused the devastating flash floods over the weekend of July 4 is traced to a convective vortex that formed when lingering Gulf moisture from Tropical Storm Barry stalled over the Hill Country. The slow-moving storm produced rainfall rates topping 3 inches per hour, creating an explosive rise in the Guadalupe River.

Historic record levels were measured at stream gauges across the region. Stream gauge data in Hunt, Texas showed the river rose roughly more than 30 feet in 95 minutes, with one sensor failing after topping out over 37 feet, a record level for that area. Meanwhile, gauge data in Kerrville, Texas showed the river surged roughly 22 feet in one hour, cresting near 34 feet.

Looking ahead

Communities along these rivers now grapple with immense loss while confronting a massive cleanup, including rebuilding roads and infrastructure. Homeowners face the daunting task of repair and recovery, and for some it will be without the financial support of flood insurance.

Flood insurance will be the primary mechanism for financial recovery for homeowners with flash flood-damaged property. But flood insurance is not included in standard homeowner’s insurance. It is only required for homes that have a mortgage within the Special Flood Hazard Area.

Unfortunately, flood insurance penetration is low in the counties hit hardest by the flash flooding. An initial analysis of the National Flood Insurance Program policies in force in the nine counties eligible for Federal Individual of Public Assistance shows that there is low take up of flood insurance in the hardest-hit areas. Across the nine counties, there are under 14,000 policies in force.

Cotality continues to analyze the impacts of this event and may provide more information once available.