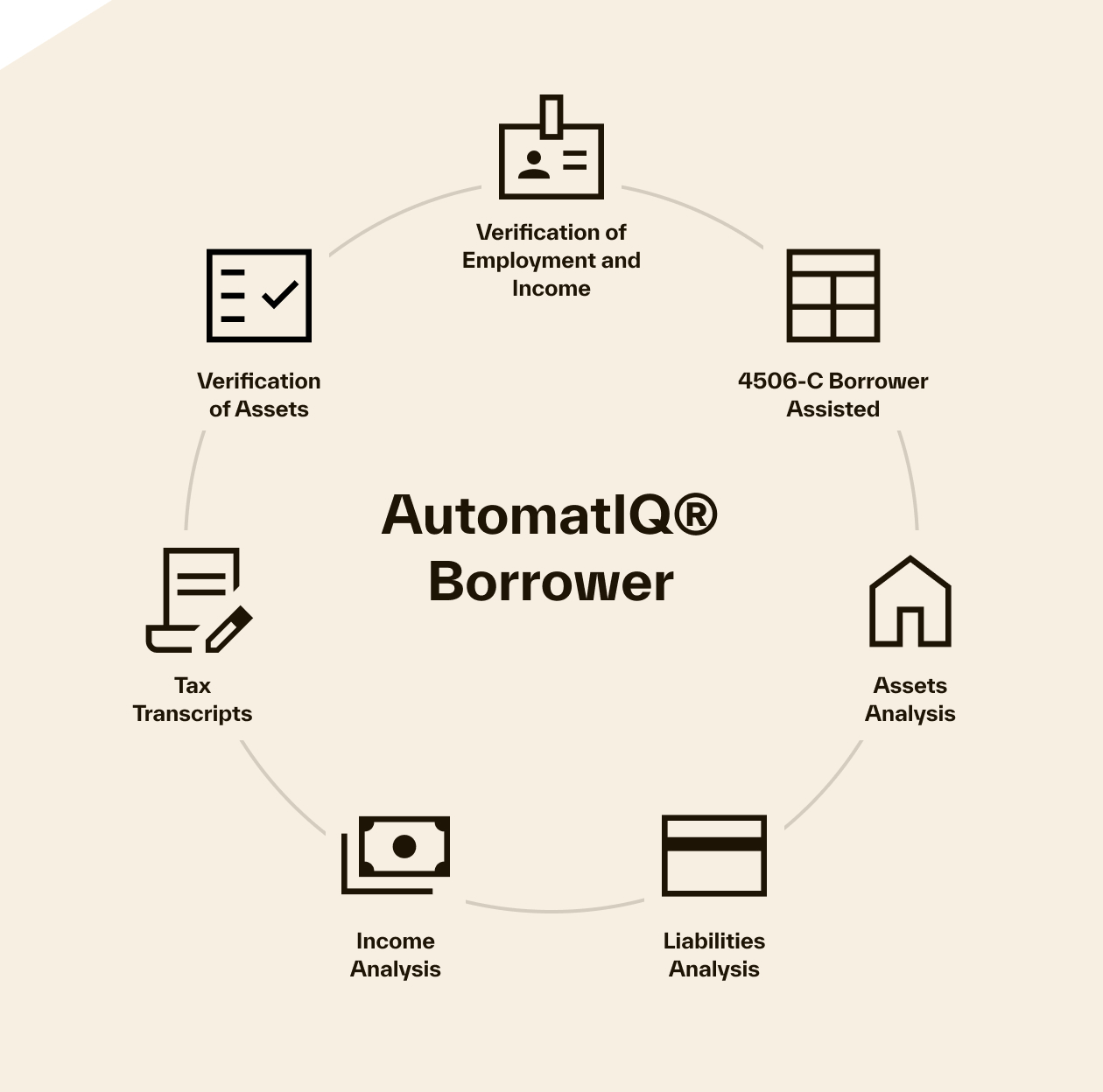

AutomatIQ® Borrower

One seamless mortgage lending workflow

Seamless, automated borrower verification

AutomatIQ Borrower transforms the manual operations of borrower verification and qualification into ONE seamless, automated workflow.

Starting with our verifications solutions, you'll experience unmatched accuracy in handling digital or physical documents for simple or complex borrower profiles. Next, seamlessly move to our qualification solutions for deep, actionable insights into the borrower’s financial health.

How people are using AutomatIQ Borrower

Comprehensive verification solution

Whether dealing with employed, self-employed, or non-traditional income earners, AutomatIQ Borrower offers a unified platform to verify employment and income. Regardless of borrower type , you can process loans knowing that verification is covered.

Enhanced processing speed and accuracy

AutomatIQ Borrower uses advanced algorithms and a vast array of data to expedite verification. Minimize errors and reduce manual review time through automation, for faster loan decisions and a streamlined customer experience.

Comprehensive financial view

Integrating VOE/I, tax transcripts, and VOA with income, liability, and asset analysis, AutomatIQ Borrower provides an unrivaled financial perspective. This holistic view facilitates informed lending decisions and manages risk.

Discover the power of one comprehensive suite

Embrace AutomatIQ Borrower’s potential to reshape your lending operations. Choose the entire product suite to witness how our technology can propel your business into the future of lending excellence.

Income Analysis

Automate income validation within a single workflow

ExploreLiabilities Analysis

Faster, more efficient liabilities analysis

ExploreAssets Analysis

Tailored asset analysis for accurate results

ExploreVerification of Assets

Asset verification made simple

ExploreVerification of Employment and Income

Secured employment and income verification

Explore4506-C Borrower Assisted

Faster verification, real-time tax transcripts

ExploreTax Transcripts

Accelerated tax transcript retrieval

ExploreHow can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.

Trying to reach us by phone?

Get in touch with our sales team at (866) 774-3282. We're here Monday to Friday from 7 a.m. to 5 p.m. CT.

Looking for support?

Visit our dedicated support page to find support for all our products.

Legal callouts